“I was shocked when I discovered the water seeping up through my kitchen floor,” recalls John from Armagh. “I felt completely overwhelmed and had no idea how to start the insurance claim process. I remember feeling lost, not knowing where to turn or what to do next.”

The Problem:

- Unnoticed leak from copper pipes beneath John’s kitchen floor tiles, leading to significant water damage throughout the ground floor of his home. John booked an appointment with PCLA’s Leak Detection Specialists.

- Emotional distress from discovering extensive damage to his property and concern about potential structural issues.

- Anxiety about the insurance claim:

- Facing a complex claims process without expert guidance.

- Fear of not receiving a fair settlement from the insurance company.

- Uncertainty about how to ensure he would get the maximum settlement he was entitled to.

- Pain Point:

- Worried about dealing with loss adjusters employed by the insurance company, John sought someone to represent his interests and take the stress out of his insurance claim. Learn more about PCLA’s Loss Assessor Service.

How PCLA Maximised John’s Water Damage Claim in Armagh

Timeline of the Case:

- Day 1: John discovers the water damage and contacts PCLA for assistance. “I remember feeling a glimmer of hope when I spoke to PCLA for the first time. They listened to my concerns and assured me they could help.” What is Trace and Access Cover?

- Day 2: PCLA conducts a free, no-obligation survey, assessing the full extent of the property damage. “They were so thorough. It felt like, for the first time, someone really understood the extent of what I was dealing with.”

- Week 1: A dedicated claims team compiles the details of John’s claim, managing the insurance claim process on his behalf. “I could finally breathe a little easier knowing that professionals were handling everything.”

- Week 2: PCLA engages with the loss adjusters employed by the insurance company, advocating for John’s interests. “They were in my corner, fighting for what I deserved. I felt supported every step of the way.”

- Week 5: A settlement of £25,000 is negotiated, ensuring John receives everything he is entitled to under his policy. “When I heard the final settlement amount, I was relieved beyond words. It was more than I expected, and it meant I could restore my home without worry.”

PCLA’s Actions:

- Expert Assessment:

Qualified loss assessors and building surveyors performed a thorough evaluation of the damage to John’s property, identifying all affected areas. “They didn’t miss a single detail. Their expertise made all the difference.” - Claims Management:

Managed the entire water damage claim from start to finish, allowing John to avoid the stress of navigating complex claims. “It felt like a huge weight was lifted off my shoulders. I didn’t have to worry about the paperwork or dealing with the insurance company.” - Negotiation:

Negotiated with the insurance company to get John the maximum settlement under the terms of his policy, leveraging their knowledge of insurance policies. “PCLA knew exactly how to handle the insurance company. I felt confident that they were getting me the best possible outcome.” - Outcome with Specific Figures:

- Initial Offer from Insurer: £18,000

- Settlement Secured by PCLA: £25,000

- An increase of approximately 39%, enabling John to fully restore his home without financial burden. “That extra amount made all the difference. I could fix everything properly without cutting corners.”

Why Choose PCLA?

- Maximise Your Claim Value:

Clients often receive up to 40% higher settlements with our claims management service. - Authorised and Regulated:

Authorised and regulated by the Financial Conduct Authority, ensuring professional and ethical service. - Experienced Professionals:

Our team comprises qualified loss assessors, building surveyors, and insurance claim professionals with over 20 years of experience. - Client Satisfaction:

Over 220 5-star reviews from satisfied clients across Northern Ireland. “Every positive review I read about PCLA was absolutely true. They truly care about their clients.” - Independent Loss Assessors on Your Side:

As independent loss assessors, we work on your behalf—not the insurance company’s.

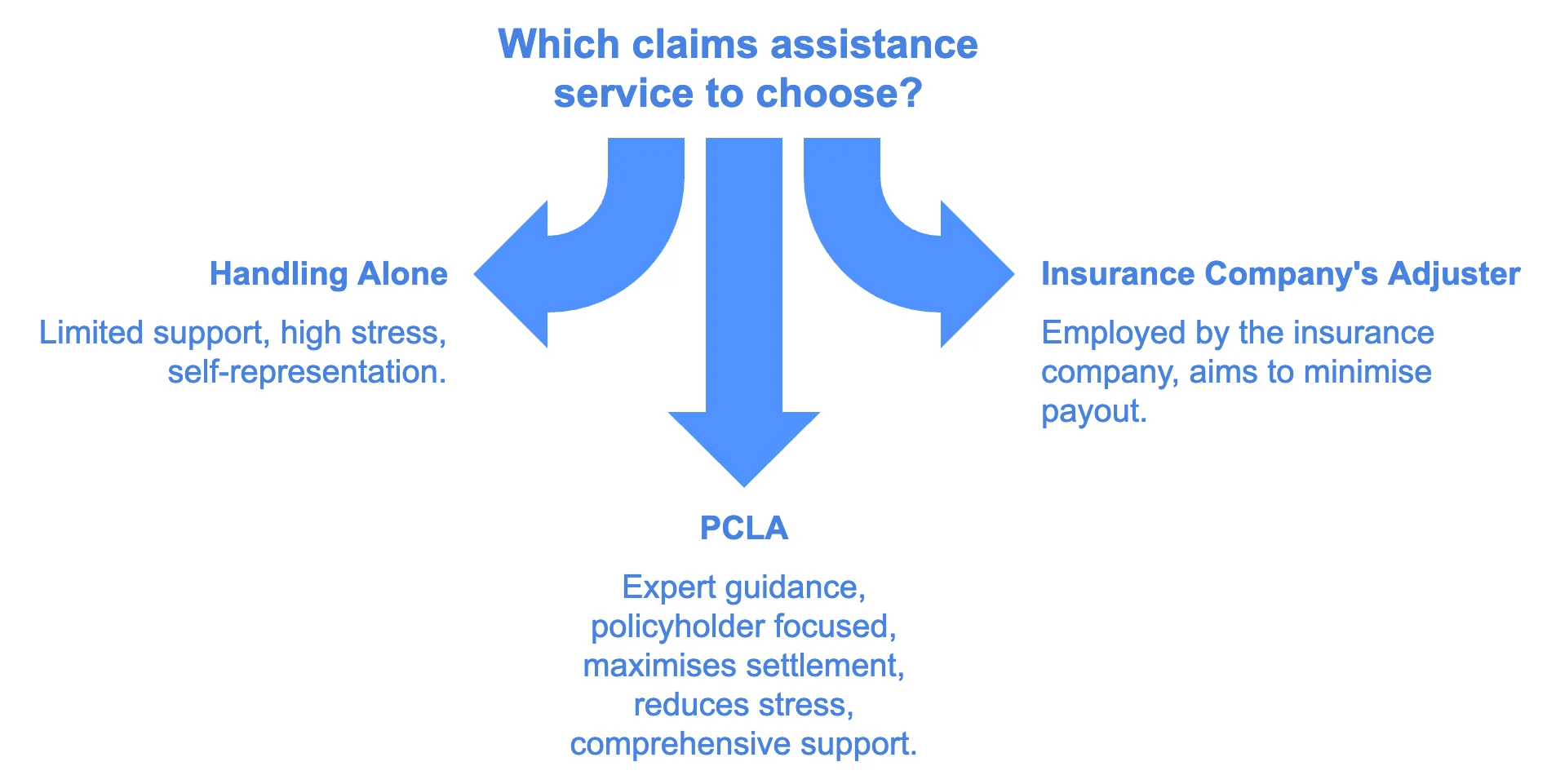

Handling Claims: PCLA vs. Going It Alone

| Feature | Handling Alone | Insurance Company’s Adjuster | PCLA |

|---|---|---|---|

| Expert Guidance | Limited | Limited | Experienced Professionals |

| Representation | Self-Represented | Employed by the Insurance Company | Policyholder Focused |

| Maximises Settlement | Uncertain | Aims to minimise payout | Up to 40% More |

| Reduces Stress | High Stress | Moderate Stress | Comprehensive Support |

| Assessment Within 24 Hours | Delayed | Possible Delays | Guaranteed |

John’s Testimonial

“PCLA made a world of difference when I discovered the water damage in my home. From the very first call, I felt heard and supported. Their team took care of every detail, allowing me to focus on my family during a very stressful time. They fought to get me a settlement that was significantly higher than what the insurance company initially offered. Thanks to PCLA, I could restore my home properly, without financial strain. I can’t imagine going through this without their help.” – John, Armagh

The Benefits of Using PCLA for Your Insurance Claim

Maximise Your Settlement:

We ensure you get the maximum settlement you’re entitled to, leveraging our expertise to maximise your claim value.

Professional Claims Management:

Manage your insurance claim entirely, dealing with the complex claims process so you don’t have to.

Expert Negotiation:

Our experienced loss assessors specialise in negotiating with the insurance company, striving for a fair settlement.

Peace of Mind:

Take the stress out of your insurance claim, allowing you to focus on restoring your home and life. “With PCLA handling everything, I could finally sleep peacefully at night.”

Regulated and Qualified:

- Authorised and regulated by the Financial Conduct Authority.

- Team includes qualified loss assessors and building surveyors.

Local Expertise:

As a leading loss assessor in Northern Ireland, we understand the unique needs of homeowners and businesses in the region.

What is a Loss Assessor and How Can They Help with Your Insurance Claim?

A loss assessor is a professional who acts on behalf of the policyholder to manage and maximise their insurance claim. Unlike loss adjusters, who are employed by the insurance company, loss assessors work on your behalf to ensure you receive everything you are entitled to.

- Manage Insurance Claims On Your Behalf:

Specialise in handling the intricacies of the insurance claim process, saving you time and reducing stress. “Their expertise made navigating the claim so much easier.” - Expert Knowledge:

Use extensive knowledge of insurance policies to identify all claimable aspects and maximise your settlement. - Negotiation Skills:

Negotiate the best possible settlement under your policy’s terms, ensuring a fair settlement.

Understanding the Role of a Loss Assessor vs. Loss Adjuster

Loss Adjuster:

- Employed by the insurance company.

- Aims to assess the claim and often seeks to minimise the payout.

Loss Assessor:

- Works on your behalf.

- Aims to maximise your claim value and ensure you receive a fair settlement.

- Provides expert guidance and handles negotiating with the insurance company.

Why This Matters:

- Having a loss assessor to represent you can significantly impact the outcome of your claim.

- Using a loss assessor like PCLA helps you navigate the complex claims process effectively.

When Should You Consider Using a Loss Assessor for Your Home Insurance Claim?

- Immediately After an Incident:

Engaging a loss assessor early ensures your claim is handled correctly from the outset. - Complex Claims:

If facing extensive property damage or a complex claims process, a loss assessor can help. - Desire for Maximum Settlement:

To ensure you get the maximum settlement, appoint a professional loss assessor. - Need for Expert Representation:

If you prefer not to deal directly with loss adjusters employed by the insurance company.

FAQs

Why should I appoint a loss assessor like PCLA?

Appointing a loss assessor ensures you have an expert to represent your interests, manage your claim, and negotiate the best possible settlement with the insurance company.

How quickly can PCLA start working on my claim?

We begin assessments within 24 hours of being contacted, providing prompt support when you need it most. “Their quick response was exactly what I needed during such a stressful time.”

Do I need a loss assessor for my insurance claim?

If you want to maximise your settlement and reduce stress, using a loss assessor like PCLA is highly beneficial.

How does a loss assessor work?

A loss assessor works by assessing your property damage, compiling your claim, and negotiating with the insurance company to ensure you receive everything you are entitled to under your policy.

How is PCLA compensated for their services?

We operate on a no-win, no-fee basis—you only pay us when you receive your settlement. “Knowing I didn’t have to pay upfront made it an easy decision.”

Can PCLA handle all types of property damage claims?

Yes, we specialise in a wide range of claims, including water damage, fire damage, leaks in your home, and business interruption claims. Learn How to Make a Successful Fire Damage Insurance Claim.

Don’t Let Insurance Hassles Hold You Back: Get the Settlement You Deserve with PCLA

Experiencing property damage is overwhelming. Navigating the insurance claim process alone can lead to stress, delays, and a lower claim settlement than you’re entitled to.

Without expert assistance, you might struggle with the complex claims process, face challenges in negotiating with the insurance company, and risk not receiving a fair settlement. This can hinder your ability to repair your property and move forward. “I knew that without help, I wouldn’t get what I deserved.”

PCLA’s experienced loss assessors are here to work on your behalf. We’ll manage your claim, negotiate the best possible settlement, and strive to ensure you receive the maximum settlement under your policy.

If you’re facing a situation like John’s, let us help you regain peace of mind and ensure you receive everything you are entitled to.

Call Today To Arrange Your Free Claim Assessment: Call 028 9581 5318

PCLA – Property Claims Loss Assessors – Authorised and Regulated by the Financial Conduct Authority.

We take the stress out of your insurance claim, providing you with the peace of mind that experienced professionals are working on your behalf to secure the best possible settlement.